Average paycheck tax

Its property taxes are also below average when compared to other states. Detailed Wisconsin state income tax rates and brackets are available on this page.

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

However it may provide even more value spread out throughout the year rather than receiving it all at once.

. Tax withheld to date or per paycheck. If you are a seasonal or new business you will use different applicable time periods for your calculation. Since exemptions vary by county it is useful to compare effective tax rates.

Ohio Taxable Income Rate. Louisiana has three state income tax brackets that range from 200 to 600. Ordering tax forms instructions and publications.

One of Oregons redeeming tax qualities is its absence of state or local sales taxes. Government Publishing Office Page 134 STAT. Though sales taxes in Louisiana are high the states income tax rates are close to the national average.

116th Congress Public Law 136 From the US. In 2005 the. How to Adjust Tax Withholding From Your Paycheck Accurately calculate your withholding for federal income taxes.

Understanding California Tax Withholding on a Paycheck. Before sharing sensitive information make sure youre on a federal government site. This windfall at tax time can be handy.

In 2018 the average CEOs compensation from the top 350 US firms was 172 million. Someone would have to pay just the right amount of taxes so. Consolidated Appropriations Act 2021 into law on Dec.

Employment of registered nurses is projected to grow 9 percent from 2020 to 2030 about as fast as the average for all occupations. The effective tax rate is the median annual tax paid in the county as a percentage of the median home value. The income tax rates for the 2021 tax year which you file in 2022 range from 0 to 54.

Were here for you when you need us. Figuring out California withholding on a paycheck can be complicated. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

Download Wisconsin Tax Information Sheet Launch. Hawaii Property Tax Rates. Many of those openings are expected to result from the need to replace workers who transfer to different.

Had an average of 200 or fewer employees each year after 1996. Get your taxes. Note that although this will result in slightly smaller paychecks each pay period your tax bill may turn into a refund come tax time.

TAX DAY IS APRIL 17th - There are 223 days left until. The gov means its official. Unlike most other states in the US Pennsylvania does not exempt contributions to 401ks 403bs and other retirement accounts from income taxes and.

The IRS will process your order for forms and publications as soon as possible. The IRS will process your order for forms and publications as soon as possible. Federal government websites often end in gov or mil.

Save more with these rates that beat the National Average. Call 800-829-3676 to order prior-year forms and instructions. Go to IRSgovOrderForms to order current forms instructions and publications.

Unfortunately we are currently unable to find savings account that fit your criteria. For tax years beginning after 2006 the Small Business and Work Opportunity Tax Act of 2007 Public Law 110-28 provides that a qualified joint venture whose only members are spouses filing a joint income tax return can elect not to be treated as a. Overview of Louisiana Taxes.

19th out of 51. The average family pays in Wisconsin income taxes. Since 1986 it has nearly tripled the SP 500 with an average.

While the state income taxes deal a heavy hit to some earners paychecks Oregons tax system isnt all bad news for your wallet. Arkansas residents can tweak their paychecks in a few ways. Ordering tax forms instructions and publications.

Figure out which withholdings work best for you with our W-4 tax withholding calculator. Our tax pros have an average of 10 years experience. Average support for say-on-pay dropped 12 percentage points to 884 marking a record low and.

See our resources including publications research books tools career center speakers bureau and directory of professional vendors. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs. F or 2021 the LTD tax rate is 00067.

A financial advisor in Arkansas can help you understand how taxes fit into your overall financial goals. This marginal tax rate means that your immediate additional income will be taxed at this rate. That amount is subject to a 10 million cap.

Start filing your tax return now. According to the IRS over 247 million tax refunds were issued in fiscal year 2021 and the average refund was 2959. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage.

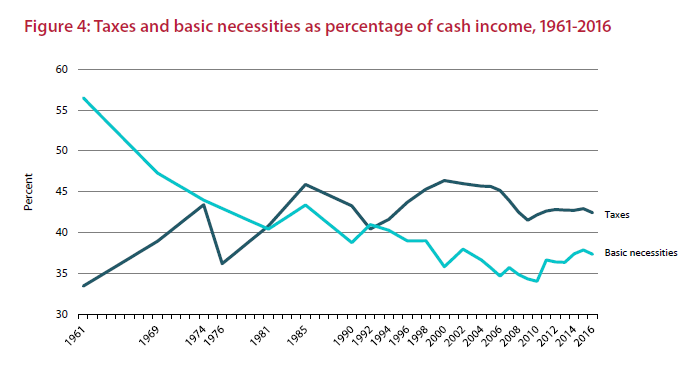

Loans can be for up to two months of your average monthly payroll costs from the last year plus an additional 25 of that amount. Go to IRSgovOrderForms to order current forms instructions and publications. The tax wedge isnt necessarily the average percentage taken out of someones paycheck.

However banks in particular continued to use life insurance policies to fund executive bonuses Disney decision. The average tax wedge in the US. The tax-loophole allowing the payouts to be free of federal income tax was closed in 2003.

About 194500 openings for registered nurses are projected each year on average over the decade. A third round of Paycheck Protection Program PPP loans was authorized by the passage of HR. Starting with tax year 2014 the top tax rate started falling from 6 to 54 over the course of five years.

How You Can Affect Your Arkansas Paycheck. Many ways to file. Payroll costs will be capped at 100000 annualized for each.

In 2014 the Missouri legislature voted to cut income taxes in the state for the first time in almost 100 years. Your employer will withhold money from your paycheck for that tax as well. Your average tax rate is 165 and your marginal tax rate is 297.

Was about 346 for a single individual in 2020. The table below shows the effective tax rates for all four of Hawaiis populated counties as well as the most recently listed rates. Call 800-829-3676 to order prior-year forms and instructions.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. In 2021 investors stepped up votes against large companies pay practices but only a little.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

The Measure Of A Plan

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Is Casdi Employer Guide To California State Disability Insurance Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Average Canadians Pay 42 5 Per Cent Of Their Income In Taxes Report National Globalnews Ca

2022 Federal State Payroll Tax Rates For Employers

Tax Refunds In America And Their Hidden Cost 2020 Edition

In 2018 The Average Family Paid More To Hospitals Than To The Federal Government In Taxes

The Measure Of A Plan

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Understanding Your Paycheck Credit Com